Zurvita Evaluation

Zurvita Holdings, Inc

At July 31, 2012, the Company had damaging working capital of about $1.five million, an accumulated deficit of roughly $20.two million and unfavorable cash flows from operating activities of roughly $2.four million. Earnings per widespread share amounted to $.03 for the year ended July 31, 2012, as compared to a loss per prevalent share of $.03 for the year ended July 31, 2011. Interest expense for the year ended July 31, 2012, was approximately $319 thousand, as compared to $362 thousand for the year ended July 31, 2011. The interest expense is a result of accreting the discount recognized on the Company’s $two million interest bearing convertible note issued on October 9, 2009. Accretion of $263 thousand is integrated within interest expense for the year ended July 31, 2012, as compared to $323 thousand of accretion incorporated inside interest expense for the year ended July 31, 2011.

Zeal

We carried out our audits in accordance with the standards of the Public Corporation Accounting Oversight Board . Those requirements demand that we plan and carry out the audit to obtain affordable assurance about no matter whether the monetary statements are free of material misstatement. An audit contains examining, on a test basis, proof supporting the amounts and disclosures in the monetary statements. An audit also consists of assessing the accounting principles utilised and significant estimates created by management, as nicely as evaluating the overall financial statement presentation. We think that our audits present a affordable basis for our opinion.

Interest and penalties connected with unrecognized tax added benefits are classified as earnings tax expense in the statement of operations. The Firm recognizes the expense resulting from all share-based payment transactions in the economic statements utilizing a fair-value-primarily based measurement approach. The Business utilizes the Black-Scholes Choice Pricing Model in computing the fair worth of warrant instrument issuances. Prior to exiting the discount fee for service company, the Business marketed subscriptions to a service that facilitates the capability of shoppers, zurvita normally small company owners, to display commercial marketing by way of an on-line search directory. Income was recognized ratably over the advertising subscription period.

As discussed in Note 1 to the economic statements, the Enterprise has suffered recurring losses from operations and has not generated sufficient cash flows from operations to meet its wants. This raises substantial doubt about the Company’s potential to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The monetary statements do not contain any adjustments that may well result from the outcome of this uncertainty.

Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the much more-most likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent most likely of getting realized upon settlement with the applicable taxing authority.

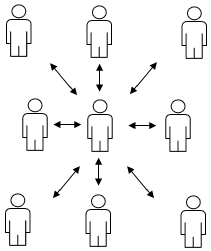

Company’s independent representatives spend a fee to the Firm entitling them to use of internet sites that facilitate their small business operations. Income is recognized ratably over the web site subscription period. Considering the fact that its inception, the Enterprise has met its capital requires principally through sale of its equity securities and the issuance of debt. The proceeds from the sale of these securities have been made use of for the Company’s operating costs, such as salary costs, qualified costs, rent costs and other general and administrative costs discussed above.

Свежие комментарии